Ethereum (ETH) Price Hits $3000 for the First Time Since 2022

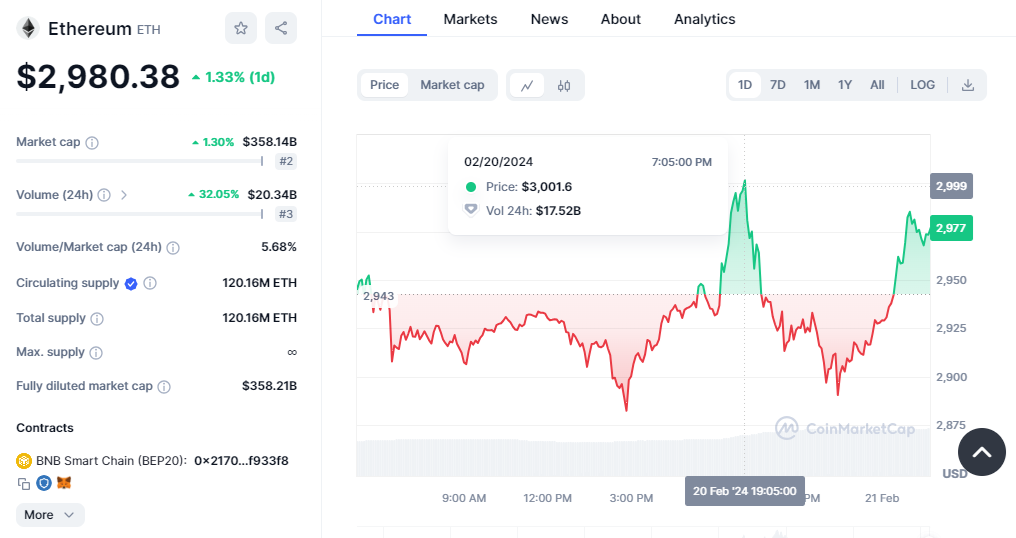

Ether surged past the $3,000 mark on February 20th, reaching a level unseen in over 22 months. This significant milestone was achieved after a notable climb from $2,881 on February 19th, marking a remarkable 4% surge within 24 hours and a substantial 74% increase over the past year. The coin hit a year-to-date high of $3,001.6 on Binance at 19:05 UTC, as reported by CoinMarketCap.

This surge in Ether's price coincides with anticipation surrounding the potential approval of a spot Ether exchange-traded fund (ETF) by the United States Securities and Exchange Commission (SEC), as well as the upcoming implementation of Ethereum Improvement Proposal (EIP) 4844 during the Dencun upgrade.

Current forecasts from Polymarket suggest a 45% likelihood of SEC approval for a spot Ether ETF by May 31st. Bernstein, a wealth management firm, has expressed optimism about Ethereum's prospects, highlighting its staking yield dynamics, environmentally friendly design, and institutional utility for building new financial markets. Analysts Gautam Chhugani and Mahika Sapra noted Ethereum's strong positioning for mainstream institutional adoption in a report on February 19th.

Eric Balchunas of Bloomberg has forecasted a 70% chance of ETF approval, contributing to a positive outlook for Ether ETFs despite regulatory delays. The last time Ether surpassed $3,000 was nearly 22 months ago, on May 4, 2022, before entering an extended bear market that saw its price plummet to $883 in June 2022.

Bloomberg ETF analyst Eric Balchunas said he expects a 70% chance of an Ethereum spot ETF being approved in May. The SEC needs to make approval decisions on multiple Ethereum spot ETF applications by the end of May, including VanEck, Ark 21Shares and Hashdex. Digital asset lawyer…

— Wu Blockchain (@WuBlockchain) January 11, 2024

The recent surge in ETH's price may also be attributed to anticipation surrounding the Dencun upgrade scheduled for March 13th. This upgrade is expected to introduce several EIPs, including EIP-4844, which introduces proto-danksharding. This upgrade aims to streamline the transaction process by storing some data off the blockchain, thereby accelerating transactions and reducing costs.

Market participants are optimistic about the continuation of bullish price action, particularly in response to any developments regarding the approval of a spot Ether ETF and potential movements in the broader crypto market.